Which is correct? Note that in the Fidelity history section, I can see the purchase of the shares and the price at which they were bought for reinvestments.

The number of shares and total value are correct, but the gain shown by Fidelity is higher than the gain shown by my program. All the dividend payouts (and their gains) are counted as pure profit in the gain columns.īut when my program (I'm trying Stock Market Eye now) downloads the dividend transaction it's putting a non-zero price per share in. This kind of makes sense since it's an IRA, so taxes are paid on the amount withdrawn and gains don't matter. The actual buys initiated by me have share price values, but all dividend reinvestments show a share price of zero. Something interesting is happening with my IRA accounts as shown by Fidelity. It can be done, but I found it much easier to enter moving forward in time. Moving backword in time is much more challenging as it is harder to validate the holdings to match the statement. Enter the statement end date and only move forward when they match. Since you have downloaded transactions and will have new transactions continued to be entered - you need to find the report or view that lets you enter a date to view current holdings. Only when they match do you move to the next statement. Start with 0 shares, enter a statements worth of transactions and verify total number of shares in the program vs. You should be able view the holdings at a specific point in time - so you can verify everything is entered correctly. If you have statements going to the beginning, I would start at the earliest date and work forward in time. I agree with livesoft - take it slowly and work towards completion. Let the program calculate the price per share. This will let you enter the transactions from Fidelity where they are only providing the #of Shares and Total Amount. In any case - if you are back-filling purchases - the guidance from both Quicken and MS Money is to enter the 2 known amounts you have - Number of Shares and Total purchase amount and let the program calculate the price. Luckily for us, the vendor that I used as the example changed to providing a price with 6 digits of significance after the decimal - so my numbers now match. Downloaded transactions never seem to be as "strict" with respect to rounding - as the amounts are all provided. If you let the program calculate the price for 44.896316 shares for $970.00 you get a price of $21.605336. I only gave them $970.00 - so it can't work. With a total purchase amount of $970.00, and those price and shares amounts - the math doesn't work. For example, one of our accounts used to provide the price to only cents (ie: $21.61) and shares purchased to 6 decimal places (ie: 44.896316). One common theme over the years about entering mutual fund purchases by hand into Quicken or MS Money is that the program needs the math to work out. Quicken and old MS Money user here - I don't know Moneyspire either. Or should I go thru and mimic what I see in Fidelity, and when Fidelity reports cost of 0 just enter it the same way? If I do it this way it's a bunch of work as there are lots of transactions over the last few years. Should I just look at the total shares owned from Fidelity, then the total shares recognized by MS, and then do subtraction on the amount of share and enter the number of shares missing? If I do this, what do I enter as cost per share? For example, if MS knows about 100 shares, and I have 1000 total, should I do a "shares-in" transaction for 900 shares? If I do this how do I calculate what the price per share should be? However, it only has a partial picture since it could only go back 60 days.

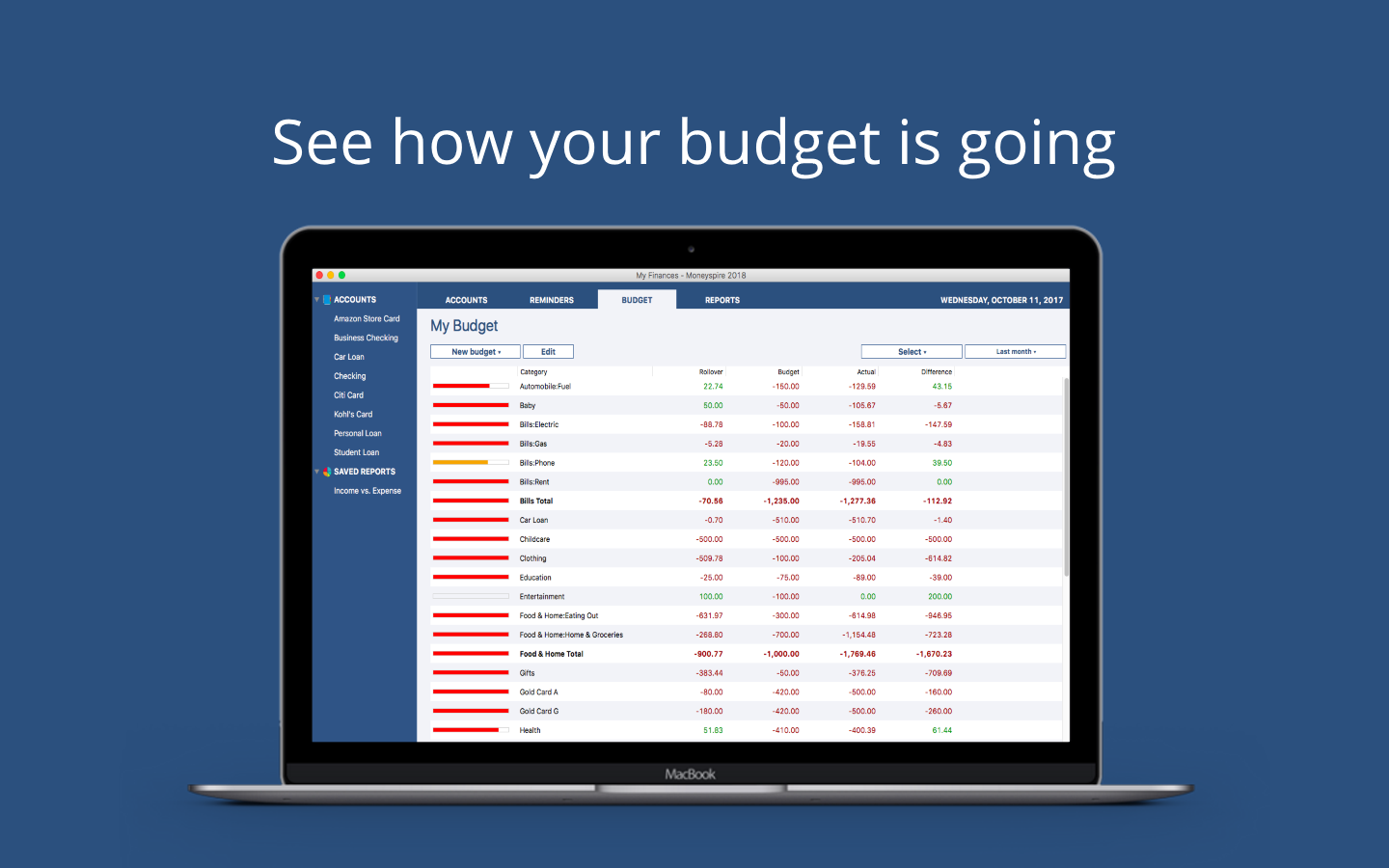

Moneyspire 2018 cost download#

Since I did a download the program has knowledge of all my securities because there has been dividend reinvestment for all of them across all accounts.

Some purchases have cost basis per share of 0. Then I look at my other accounts and the purchase price for the various lots varies in the same security. I am talking about the "Cost Basis per Share" column for anyone that uses Fidelity.ģ. I think they do this to keep cost basis calculation simplicity. For example, every transaction for FSTVX has been at 59.05 for the last few years. For one of my fidelity accounts, when I look at the Purchase History/Lots, it appears that Fidelity is doing some trick where all the purchases are for the same price.

There have also been dividend reinvestments.Ģ. I have been buying a lot of shares of the 3 fund portfolio securities for the last few year. To get the complete picture I need to enter shares that were bought more than 60 days ago. It only downloaded 60 days worth of transactions.ģ. I set it up to download my info from Fidelity. I bought Moneyspire since it was on sale for $23 over the holidays.

What is the proper way to enter transactions into finance software? Here is the scenario:ġ.

0 kommentar(er)

0 kommentar(er)